The Richest Man in Babylon Book Summary

The Richest Man in Babylon by George S. Clason is an illuminative and practical classic book on building wealth. First published in 1926, the book’s contents are a series of parables in old Babylon, offering valuable insights into saving, investing, and financial success. These lessons derived from the characters’ experiences in their respective ways provide a way for any person seeking financial freedom, which is relevant even today.

The lessons centred on financial success occur in Babylon, one of the wealthiest cities of ancient times. In this book, through storytelling, Clason brings back to life characters who try to fathom the basics of managing money wisely. Every chapter reveals another aspect of keeping and growing wealth by providing the readers with simple yet effective rules.

The story’s protagonist, Arkad, who becomes the richest man in Babylon, hosts the foundational framework of teaching for the book. Other characters join the storyline with Arkad to continue their experiences and adversities about money. Through instruction, the book teaches a person that success can be accomplished through hard work, self-discipline, and knowledge of the laws of finance.

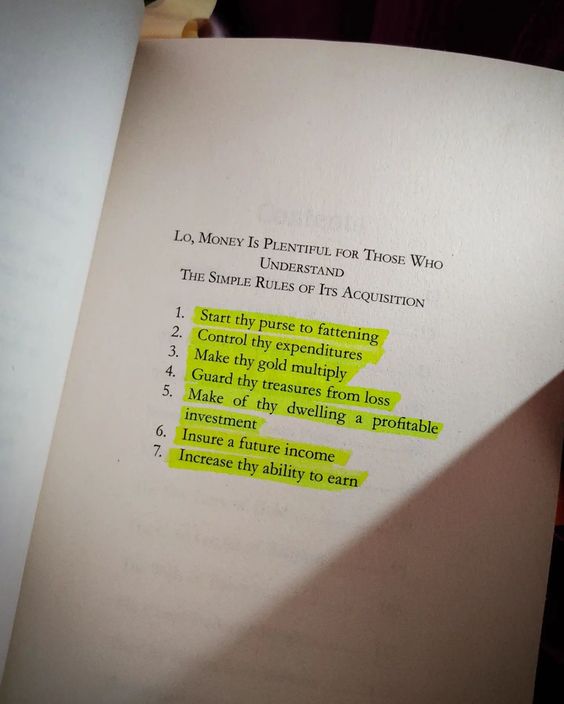

The Seven Cures for a Lean Purse – Principles of Wealth Building

In the book The Richest Man in Babylon, a man of wealth from Babylon named Arkad unveils his secret to realizing financial success. He shares seven easy-to-follow principles anyone who wants financial success has to implement, which he calls Seven Cures for a Lean Purse. These cures are programmed so that any person who embraces them will garner wealth and be freed from the noose of poverty through simple but disciplined financial habits. Let’s go through each of these cures and see what they involve.

1. Start Thy Purse to Fattening

The first cure encourages individuals to save at least 10% of their income. Arkad emphasizes the importance of paying yourself first. Before spending money on daily expenses or luxuries, ensure that a portion of your earnings is set aside for savings. This cure lays the foundation for wealth accumulation by ensuring that you are always growing your financial reserves. The habit of saving a fixed percentage of your income instils discipline and helps you build a solid base for future investments. “A part of all you earn is yours to keep.”

2. Control Thy Expenditures

The second cure deals with controlling superfluous expenses. Arkad points out that desires often outrun income, but wise men learn to be realistic when spending money. Another great thing I learned from this cure is budgeting and needs versus wants. It’s not about ‘making’ more; it’s learning to live within your means. Limiting unnecessary purchases and avoiding overspending makes room for savings and investment without feeling deprived.

The key lesson here is that controlling expenses plays an important role in building wealth. One cannot simply increase income to solve financial problems; one has to balance it with expense control.

3. Make Thy Gold Multiply

Once you have cultivated the habit of saving, the next step should be to invest your savings to develop more wealth. Arkad added that saving only is not sufficient; ensuring that the invetments are earning is also important. By making wise investments, your savings will increase significantly because of compounded returns. It is pointed out in the book that you must make cautious, well-researched investments and stay away from speculative ventures promising very high returns but carrying serious risks. Investing in stable, profitable opportunities ensures your wealth grows over time, creating a steady stream of passive income.

4. Guard Thy Treasures from Loss

The fourth cure for the lean purse is protecting wealth from risky investments. Arkad warns investors against investing their money in schemes which sound too good to be true or entrust to people with little experience. Protection of the investments made is equally important as investing. It is always essential to seek financial advice before investing your money. In short, guarding thy treasures from loss is done by making sound and calculated decisions instead of chasing speculative gains.

5. Make of Thy Dwelling a Profitable Investment

The fifth cure in The Richest Man in Babylon is acquiring one’s own home. According to Arkad, owning a house reduces an individual’s cost of living as well as equity over time. Instead of paying rent benefiting a landlord, owning one’s property allows you to build a valuable asset class. Furthermore, he adds that ownership provides security and stability since one cannot be at the mercy of the rising rent costs.

6. Insure a Future Income

The sixth cure emphasizes that one needs to consider old age and plan for it by establishing a reliable passive income stream for later years. Arkad encourages people to invest in viable ventures that generate income and care for them even after their retirement or in conditions that render them unable to work actively. This may be about long-term investment plans, pension plans, or passive income streams.

The idea here is similar to retirement planning; you want to make sure that, as long as you have it, your resources will be sufficient for you after the regular paycheck stops coming along. Arkad further encourages the protection of the family’s financial security, using life insurance or another form of long-term financial protection.

7. Increase Thy Ability to Earn

The final cure for a lean purse is increasing your earning potential through continuous self-improvement. Arkad encourages readers to continuously learn new skills, acquire more knowledge, and look for ways to continuously improve their professional abilities. As your skills improve, so do your earning capability and new avenues toward prosperity.

This cure reminds the readers that building wealth is not all about saving and investing but about perfecting oneself to increase income. Whether through formal education and training or seeking better employment opportunities, improving earning power is the most important component in financial success.

Conclusion

The Richest Man in Babylon is a must-read book for anyone who wants to be financially secure or prosperous. Its timeless principles remind readers that when it comes to building wealth, it is all about consistent habits, practical wisdom, and staying clear of the pitfalls of impulsive decisions. Whether you want to save more, get out of debt, or invest wisely, this book has some real advice to change your financial life forever. As Arkad says, “A part of all you earn is yours to keep,” that simple lesson can be the key to a life of financial abundance.